Inflation rates are well known to affect the prices of most, if not all assets, including real estate and housing prices. As the purchasing power of the US Dollar decreases, the costs of most assets typically go up. This can be felt by consumers across the board as prices of gasoline, groceries, and housing tend to rise.

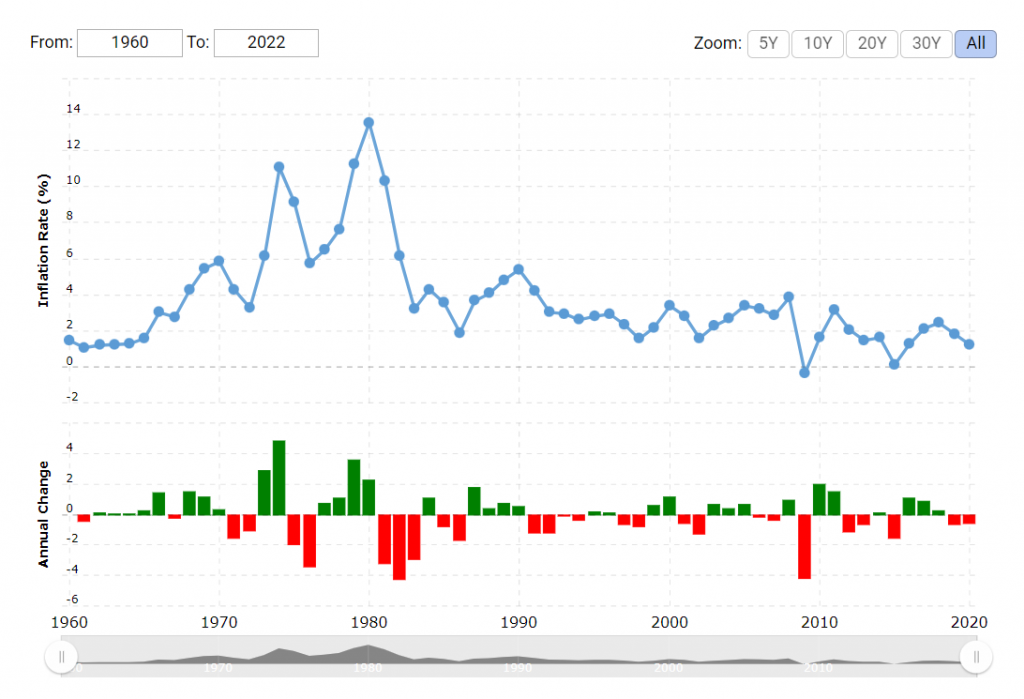

Typically the rate of inflation has been rather low in the USA in comparison to other countries. As per MacroTrends, inflation rates have been rather steady in recent decades and usually are between 1-3% on average. These rates have assisted property value in the USA to increase steadily in value and appreciation.

In early 2020, the Covid-19 global health crisis erupted across the globe. As fears spread across the world, financial markets descended into chaos initially. The rate of crude oil went negative, something that was never seen before historically. Other markets including “safe haven” assets such as gold and cryptocurrencies have also reported major losses at first.

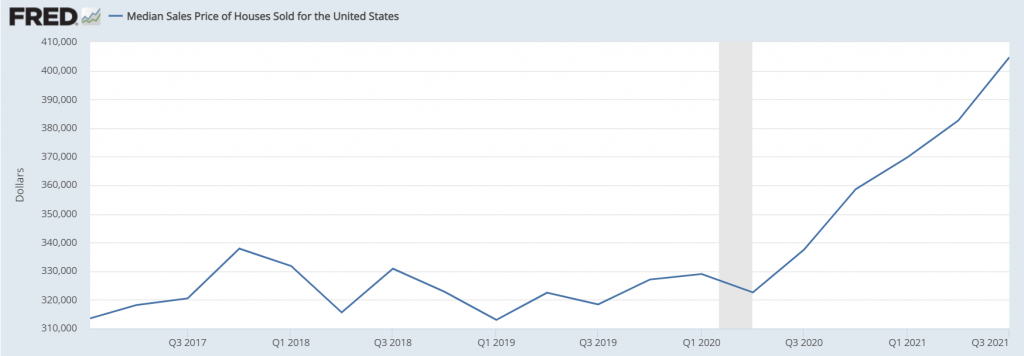

As Covid-19 erupted across the globe there were periods in which eviction moratoriums or emergency bans on eviction were issued. Essentially that meant that some investors may have taken a loss on rental properties in some parts of the USA. Traditional logic would suggest that prices of residential housing may fall due to low return-on-investment (ROI). Despite this, the price of housing never crashed at any stage of the Covid-19 pandemic according to the Federal Reserve Bank of St. Louis. As a matter of fact, the opposite occurred and Median Sales Price of Houses Sold for the United States rose.

This may indicate that the strongest form of “safe haven” asset might be real estate. As the population across the globe and in the USA is steadily increasing, housing will always be needed. Even during a global crisis, such as Covid-19 prices of residential housing have increased.

Inflation Post-Covid

Following the Covid-19 pandemic, fears regarding inflation have risen. This has initially been described as “transitory inflation” by the US Treasury Secretary, Janet Yellen. In recent days however Yellen has seemingly backtracked according to the New York Times. Following the new Omicron variant, Yellen seems to suggest that inflation may be here to stay:

“Now the new variant, the Omicron variant — the pandemic could be with us for quite some time and hopefully not completely stifling economic activity, but affecting our behavior in ways that contribute to inflation,” Ms. Yellen said, speaking at an event sponsored by Reuters.

Many other officials in the US are retiring the term “transitory inflation”. This includes Fed Chairman Jerome Powell and even the White House. It seems as though higher inflation rates in the USA are more than likely to occur. The biggest question is how high will inflation rates rise, and will we see a situation similar to the 70’s in the USA? The 1970’s were known for the highest inflation rates seen in U.S. history and reached 14% at its peak.

Housing & Rental Markets During Covid-19 and Beyond

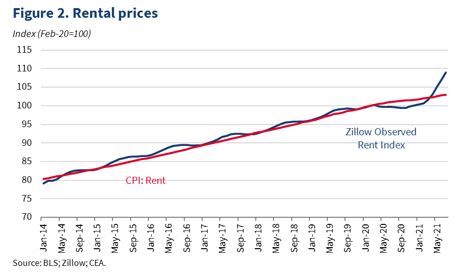

The White House released an official report on the housing markets and inflation. While rental prices did experience a minor dip in 2020, it seems that pricing is now exceeding expectations. It seems likely that this trend may continue for the next upcoming months before we see a return to the median average.

This is a boon for existing real estate investors and landlords as their APY or Annual Percentage Yield is due to increase. In layman’s terms, real estate investors are due to earn more, quite likely outpacing inflation.

One likely culprit for the rise in pricing, beyond a growing population and limited resources is once again, inflation. As the prices of lumber, steel, and iron are increasing, the costs of building a new home are higher. This affects the costs of existing housing as they rise in tandem if properly maintained. As the prices of properties to purchase are surging, so does the price to rent.

What to Expect in 2022?

If the government officials in Washington are correct, we will likely see inflation above normal levels in 2022. Some in the media are even claiming that 70’s style of inflation may make a resurgence. While the exact rate of inflation isn’t exactly clear, there seems to be full consensus that higher than average inflation will occur.

The inflation rates will boost average property evaluations and average rental rates. This could lead to further investor interest which could push the market even further. Essentially real estate may see a significant boom in the upcoming years as the specter of inflation looms.

Seeing that many corporations are still allowing employees to work remotely, we may see above-average growth outside major cities. Current trends seem to show a movement from major cities to suburbs and less populated regions.

It seems like 2022 will be an interesting year for “safe haven” assets and especially residential real estate.