Safe haven investments are quickly becoming a top niche in the world of investments in 2022. The traditional stock markets are not performing as they used to and the specter of inflation looming. Everyone seems to be looking for a safe spot to “park” and grow their capital in a way that will outpace inflation.

This is causing many to look into “safe haven” assets. Safe-haven assets and investments are typically used to offset risks and limit portfolios to negative shocks in the market. During times when the market is bearish or going through some type of crisis, safe havens are expected to maintain their value and possibly grow.

What Are Safe Haven Assets?

There are several different assets that are considered safe-haven investments. This can include treasury bonds, “defensive” stocks such as food producers, and even foreign currencies such as the Swiss Franc. The most popular safe-haven investments however are limited assets. This includes precious metals such as gold, property investments, and limited cryptocurrencies such as Bitcoin.

Despite property, gold, and Bitcoin being considered safe-haven assets, they are very different from each other. Each asset has a different market, different trading hours, and vastly different volatility. We will have a brief look into each of these assets and list their advantages and risks.

Gold & Precious Metals – A Bit of Background

Since the dawn of man, people have associated gold with value. Sometime around 650 B.C., the ancient Greeks started minting coins out of precious metals such as gold and silver. The ancient Chinese dynasties and Persians may have predated the Greeks, although it isn’t very clear. Regardless, gold has been linked to rarity and prestige for as long as anyone can remember, even before the use of coins.

Most currencies were linked to the value of gold or silver in the past. The U.S. Dollar used to be backed by gold until the 1970s, while the British Pound is also called a Pound Sterling due to its previous link to sterling silver.

Ever since currencies were decoupled from precious metals, they became an investment asset. They are touted by economists such as Peter Schiff, as an ideal hedge against inflation and a true store of value. This is due to the fact that it is not dependent on governments, has uses in industry, art, and jewelry, and isn’t linked directly to stock markets.

Gold as an Investment

Some invest in gold via ETFs, by investing in gold miner stocks, or buying gold contracts, but purchasing gold physically is still very popular. This is typically done by purchasing gold bullion or coins. This can cause some storage expenses as a safe or secure form of storage is recommended.

Gold can be seen as a way to both preserve wealth and hedge against the dollar. In the very long term, it can be a viable investment. According to historical data, a gram of gold cost $4.36 in 1977, in 2022 a gram of gold costs $62. If one factors in inflation, $5 in 1977 should now be worth roughly $22. This can be proof of sorts that gold could be a good store-of-value and investment opportunity depending on the conditions and terms of investment.

Gold does have certain risks associated with it as an investment. It is a rather slow mover, typically slower than stocks. In addition to that, gold can go through very long stretches of decline with very low investor interest.

For example, gold reached a local peak in 1981 and only overtook it in the late 2000s following the subprime mortgage crisis. As such, it is not usually seen as a good investment for short term or some long term investments. At best, it should be seen as a very long term investment or a minor portion of a portfolio.

Bitcoin & Cryptocurrencies

Cryptocurrencies and Bitcoin are a divisive topic to many in the world of traditional finance. Many older thought leaders in the world of finance seem to hold a negative view of blockchains and digital currencies including Warren Buffet and Ray Dalio. Despite this, the younger generation seem to be entranced by the orange coin and newer cryptocurrencies that followed. The traditional world of finance seems to slowly be warming up to Bitcoin as a legitimate investment.

Bitcoin, like gold, is limited by nature. Its creator, Satoshi Nakamoto set the number of Bitcoin to 21 million by design and there are only 18 million in circulation currently. The remaining 3 million are either lost or slowly entering the ecosystem via a process called Bitcoin mining. Like gold, Bitcoin cannot be replicated, counterfeited, or copied. This may be why some refer to it as “digital gold”.

Unlike gold, Bitcoin has no intrinsic value and is only code floating around the internet. It is also a rather new asset that was launched in 2009 by a mysterious anonymous creator.

Bitcoin & Cryptocurrencies as an Investment

Bitcoin is one very volatile asset class and most other cryptocurrencies are more so. Some became very wealthy by investing early or by day trading. Others have reported major losses due to entering and exiting the market at the wrong time.

Due to its volatility, Bitcoin and cryptocurrencies can be a fine investment regardless of the timeframe. This volatility can work both ways, however. Due to the sharp volatility, it may not be a true store of value. In addition to this, there seems to be some correlation between Bitcoin and tech stocks. This is possibly due to some companies accepting it as a payment or placing a portion of their balance sheet in Bitcoin.

As its adoption is still growing, Bitcoin could be a fine long-term investment as well. Regulations and taxation could still be an issue, however. It also seems to go through a “boom to bust” cycle every four years or so with sharp peaks and deep valleys.

Property

Land, like gold, always had value in the eyes of people, since the dawn of mankind. Land is a limited asset and the number of people across the globe is constantly increasing. Property or a roof above one’s head is at the bottom of Maslow’s hierarchy of basic needs for individuals.

Real estate can also have an intrinsic value of sorts as land and property can be utilized in different ways. As such, one can conclude that real estate may always be needed and therefore potentially profitable.

Property in the USA as an Investment

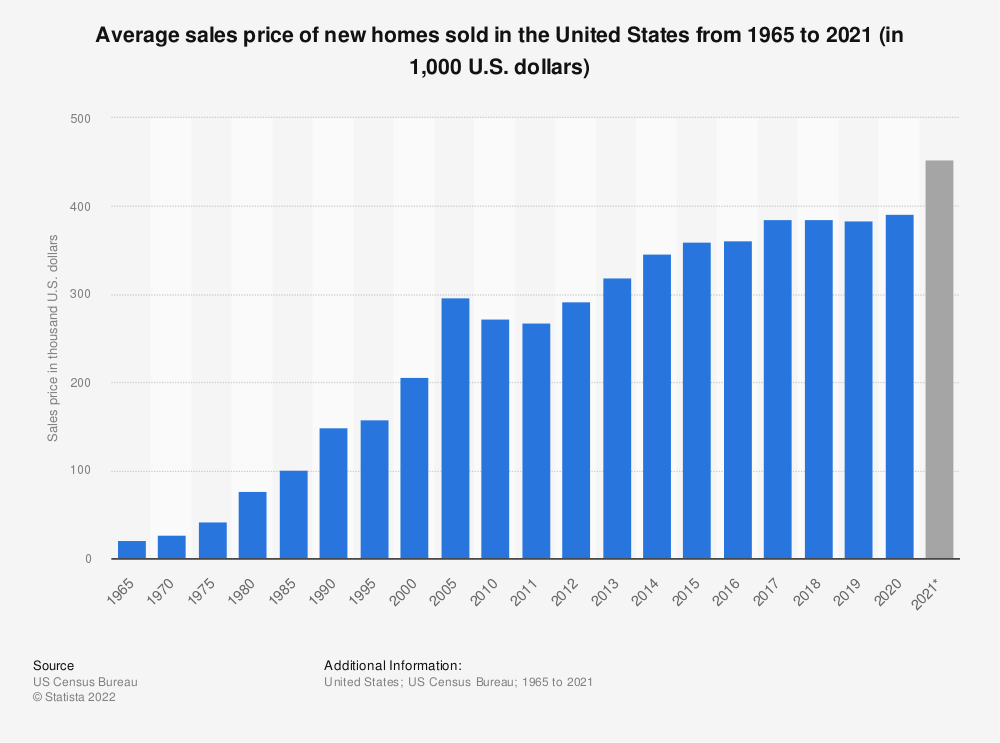

While property across the globe can vary, property prices in the United States as a whole have been steadily increasing. There have been a few minor anomalies, such as in the years 2005 to 2010 when the market went through the subprime mortgage crisis and experienced a minor decline. The market swiftly corrected itself and housing prices continued to increase at a steady rate.

This seems to suggest that property & real estate investments seem to be a very viable option for investment regardless of timeframe. The data seems to imply that real estate in the United States can be profitable both as a short term investment as well as a long term one.

The United States is a very large country, and as such some areas may experience faster growth than others. Growth in some regions in recent years has vastly outpaced others, such as Florida which has seen a major influx of new residents. New York on the other hand has seen a bit of decline population-wise ever since the Covid-19 pandemic.

Despite being a very attractive and viable investment, US property and real estate is inaccessible to many across the globe. This is due to the high entry costs to purchase property as a cash deal and the lack of financing options for international investors.

This is slowly changing with time. Specialized mortgage lenders such as USA-Mortgages which offer financing to non-us based residential property investors. As per research by Gorback and Keys, house prices and rental costs have risen in areas that have seen large doses of foreign investment.

Should this trend continue, property and real estate in the USA can hypothetically be a great avenue of investment for both US and international investors. In addition to that, property seems like the ideal safe haven for wealth.